Reconciliation in accounting is needed whenever there are financial transactions to ensure accuracy and consistency in the records. It’s typically required at regular intervals, such as monthly, quarterly, or annually, to verify that internal records match external statements like bank accounts, supplier invoices, or customer payments. Reconciliation is also necessary before financial reporting, audits, and tax season preparation. Historical details of cash accounts or bank statements are used to identify irregularities, balance sheet errors, or fraudulent activities. One example of where this method is used is a case scenario involving a company that records an average annual revenue of $50 million based on historical records. Most importantly, reconciling your bank statements helps you catch fraud before it’s too late.

Entirely Missing Transactions

- We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

- During reconciliation, you should compare the transactions recorded in an internal record-keeping account against an external monthly statement from sources such as banks and credit card companies.

- The company’s current revenue is $9 million, which is way too low compared to the company’s projection.

- In the event that something doesn’t match, you should follow a couple of different steps.

- Bank reconciliation is an accounting process where you compare your bank statement with your own internal records to ensure that all transactions are accounted for, accurate, and in agreement.

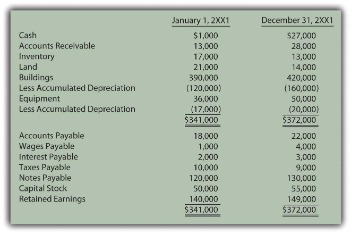

Account reconciliation is necessary for asset, liability, and equity accounts since their balances are carried forward every year. During reconciliation, you should compare the transactions recorded in an internal record-keeping account against an external monthly statement from sources such as banks and credit card companies. The balances between the two records must agree with each other, and any discrepancies should be explained in the account reconciliation statement.

If necessary, additional journal entries are made to correct any errors recognized after investigation of discrepancies. Depending on the account type, you may also require additional details presenting the whole activities executed on the account. As important as account reconciliation is in accounting, there is not much focus on it in accounting classes. In fact, many accountants can enjoy a successful career without having to perform a single account reconciliation. However, you typically only have a limited period, such as 30 days from the statement date, to catch and request correction of errors. For example, when reviewing your trial balance for the current year, you notice that your travel expenses have been averaging $1,500 a month, but in July, travel expenses jumped to $5,000.

Direct and Indirect Cash Flow

Understanding the different types is crucial for maintaining financial accuracy and transparency. Whether it’s reconciling bank statements, vendor accounts, or intercompany transactions, each type plays a pivotal role in ensuring that records are consistent and errors are promptly identified and corrected. Reconciliation in accounting—the process of comparing sets of records to check that they’re correct and in agreement—is essential for ensuring the accuracy of financial records for all kinds of businesses.

Prepare Adjusting Journal Entries

Where discrepancies arise, it helps you pinpoint the exact missing transaction and the accounting officer in charge of it. The cash account balance in an entity’s financial records may also require adjusting in some specific circumstances, if you find discrepancies with the bank statement. After fee and interest adjustments are made, the book balance should equal the ending balance of the bank account. The first step in bank reconciliation is to compare your business’s record of transactions and balances to your monthly a small-business guide to common sources of capital bank statement. Make sure that you verify every transaction individually; if the amounts do not exactly match, those differences will need further investigation. A bank error is an incorrect debit or credit on the bank statement of a check or deposit recorded in the wrong account.

If your AR balance is $60,000, but you only have $40,000 in invoices that are due, your net profit will be overstated and you’ll be paying taxes on income that you’ll never receive. Account reconciliation is a financial reconciliation, with no real difference, except for how the results of the reconciliation process will be used. Depending on your business, you may also want to reconcile your inventory account, which is typically completed by doing a complete accounting of all inventory on hand. Balance sheets and profit and loss statements are both essential resources for determining the financial health of your business.

While scrutinizing the records, the company finds that the rental expenses for its premises were double-charged. The company lodges a complaint with the landlord and is reimbursed the overcharged amount. In the absence of such a review, the company would’ve lost money due to a double-charge.

A good example of where this method is in play is where a company maintains a record of all its receipts for purchases made and, at the end of an accounting period, embarks on account reconciliation. When conducting a reconciliation, comparing the receipt records with records in a cash book, the company notices that it was charged for ten additional transactions not recorded in the cash book. bookkeeping business names Account reconciliation is the process of cross-checking a company’s account balance with external data sources, such as bank statements.

There could be a variety of issues that caused the expenses to jump so dramatically. This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

In this article, you will learn everything you need to know about account reconciliation including how account reconciliation software works. Reconciling your bank statement can help you avoid bounced checks (or failing to make electronic payments) to statement of financial position partners and suppliers. Anytime something appears out of the ordinary, you’ll want to review the originating documents such as invoices entered to determine if they were posted properly and whether any adjustments need to be made. Reviewing your comparative trial balance is one of the most important things you can do for your business. Once these adjustments are made to the general ledger, your bank account will now be reconciled with your general ledger account.